In the rapidly evolving world of finance, copy trading forex https://fx-trading-uz.com/ has emerged as a popular strategy for both novice and experienced traders. This method allows individuals to replicate the trades of successful investors, providing a potentially profitable avenue without requiring extensive market knowledge. In this article, we will delve into the fundamentals of copy trading, explore its advantages and disadvantages, and provide insights on how to effectively implement this strategy in your trading journey.

What is Copy Trading?

Copy trading, also known as social trading or mirror trading, allows investors to automatically copy positions opened and managed by a selected trader. This innovation in trading technology enables individuals who may lack the experience or time to fully engage in the markets to participate passively. By choosing a successful trader to emulate, people can potentially benefit from their expertise and time spent analyzing the markets.

How Does Copy Trading Work?

At its core, copy trading is facilitated through online trading platforms that offer this feature. Here’s how it generally works:

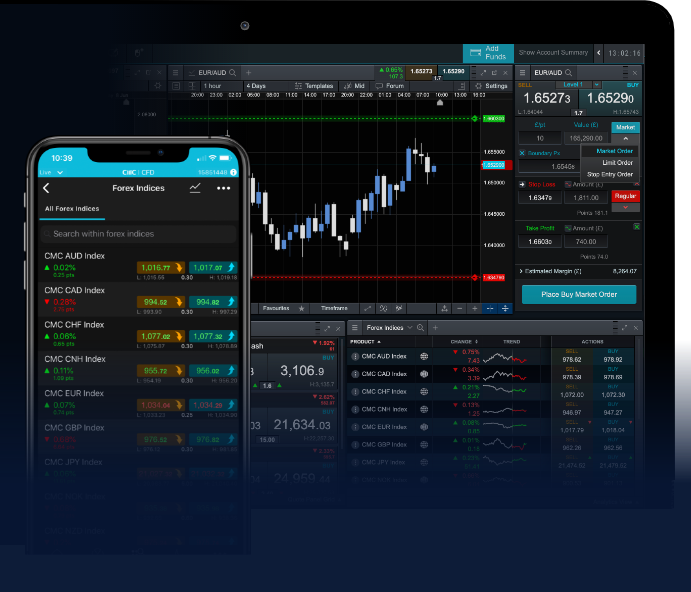

- Select a Platform: Choose a trading platform that supports copy trading. Many brokers provide this service, featuring profiles of experienced traders who are open to being copied.

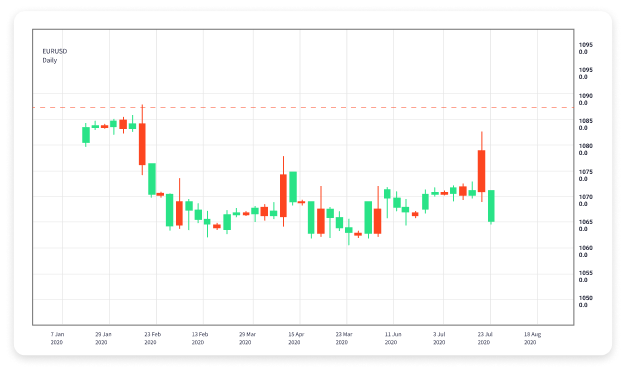

- Analyze Traders: Assess the performance of different traders based on their past results, risk levels, strategies, and trading style.

- Allocate Funds: Decide how much capital you want to allocate to copying a selected trader. This amount is typically proportional to the trades they execute.

- Automated Copying: Once you’ve set your preferences, the platform will automatically copy the trader’s actions to your account in real-time.

The Benefits of Copy Trading

Copy trading presents several advantages, making it an appealing choice for many investors:

- Accessibility: It democratizes trading by allowing those with less knowledge or experience to participate in the markets.

- Time Efficiency: Traders can save time on market analysis and finding profitable opportunities by relying on someone else’s expertise.

- Diversification: Investors can diversify their portfolios by copying multiple traders with different strategies, reducing overall risk.

- Learning Opportunity: Copy trading can provide insights into how successful traders make decisions, which can serve as a learning tool for improving one’s trading skills.

The Risks of Copy Trading

While copy trading offers numerous benefits, it also comes with its share of risks:

- Over-Reliance: Investors may become too dependent on the trader they are copying, ignoring their own judgment and analysis.

- No Guaranteed Success: Past performance does not guarantee future results. Even successful traders can experience losses.

- Fees: Some platforms may charge fees for copy trading services, which can reduce profits.

How to Choose the Right Trader to Copy

Choosing the right trader to emulate is crucial for the success of your copy trading endeavors. Consider the following factors:

- Performance Record: Look for traders with a consistent and strong performance record over time, rather than just short-term success.

- Risk Level: Understand the risk profile of the trader. Ensure it aligns with your risk tolerance and investment goals.

- Trading Style: Analyze the trader’s approach—whether they focus on day trading, swing trading, or long-term investing—and choose one that matches your style.

- Engagement and Communication: Some traders engage with their followers. Being able to ask questions and receive insights can enhance your learning experience.

Tips for Successful Copy Trading

To enhance your copy trading experience and improve your chances of success, consider the following tips:

- Start Small: Begin with a limited amount of capital to mitigate risks as you familiarize yourself with the process.

- Diversify Your Portfolio: Don’t put all your eggs in one basket. Consider copying multiple traders with different strategies to spread risk.

- Regularly Review Performance: Consistently evaluate the performance of the traders you are copying and be ready to adjust your choices.

- Stay Informed: Keep up with market news and trends, as this will help you make more informed decisions about which traders to copy or when to stop copying them.

Conclusion

Copy trading in the forex market offers a valuable opportunity for both novice and experienced traders to engage with the financial markets. By leveraging the skills and expertise of successful traders, individuals can potentially achieve greater results while minimizing the time commitment usually associated with traditional trading methods. However, it is essential to approach copy trading with caution—an understanding of the risks involved and a strategic selection of traders to copy can significantly enhance your chances of success in the dynamic world of forex trading.